Convenient Accounts

Receivable Factoring Service

Convenient

Accounts Receivable

Factoring Service

-

Application

QualificationsApplication Qualifications

Companies that issue electronic

tax invoices can use factoring. Companies that issue electronic tax

invoices can use factoring. -

Apply when issuing

a tax invoiceApply when issuing a tax invoice

You can apply with a tax invoice issued

within about 60 days. You can apply with a tax invoice issued within

about 60 days. -

Secure data

managementSecure data management

It is safe because it evaluates corporate

credit with the consent of customers. -

No paperwork

On the online application form

It's certified with corporate certificates

No document submission is required. On the online application form It's certified

with corporate certificates No document

submission is required.

Case of Using Account Receivable Factoring

-

"By covering the sales payments, we had more flexibility with our cash flow, which let us reinvest in the business.”

The Story of the Director of Meat Processing Manufacturing Plant

The director of the meat processing manufacturing plant has poor liquidity in funds, making it difficult to expand the business quickly.

This problem occurred because we had to wait for a long time for payment after issuing the tax invoice.

In response to these difficulties, by introducing the account receivable factoring service, the chairman was able to immediately secure cash as soon as he obtained the customer's consent based on the tax invoice he sold.

With the ability to quickly raise money online without complicated paperwork, this service enables immediate cash on sale, enabling immediate response to salaries, raw material purchases, and other operating expenses. In addition, cash flow has improved to allow companies to freely manage the funds needed to reinvest and expand their businesses, and to increase their credibility without having to rely on loans from financial institutions.

By managing the debt collection process, the company was able to reduce the effort and cost of collecting the bonds. As a result, the chairman was able to secure funds without financial burden and maximize the efficiency of his business through the account receivable factoring service. More details

-

"Since you helped cover the payments for our purchases, we now have some extra cash, which has really lightened the load for the business."

The story of the president of a large mart

The accounts receivable factoring service has provided a great help to buyers, especially small and medium-sized businesses like ours, where money flow management is important.

Longer payment periods can negatively impact production plans and operational efficiency, and our accounts receivable factoring service allows us to guarantee immediate payment to the seller while repaying the actual funds to the factoring company for an agreed long period of time.

As a result, our company was able to manage cash flow efficiently, and the burden on operating capital was reduced by acquiring necessary goods or raw materials without the initial financial burden.

In addition, factoring establishes buyers' position as reliable partners in transactions with suppliers, which has contributed to strengthening long-term business relationships with sellers who supply products without worrying about payment delays.

As a result, account receivable factoring was used to reduce the burden of settlement and to maximize the efficiency of business operations by securing the necessary resources and raw materials in a timely manner.. More details

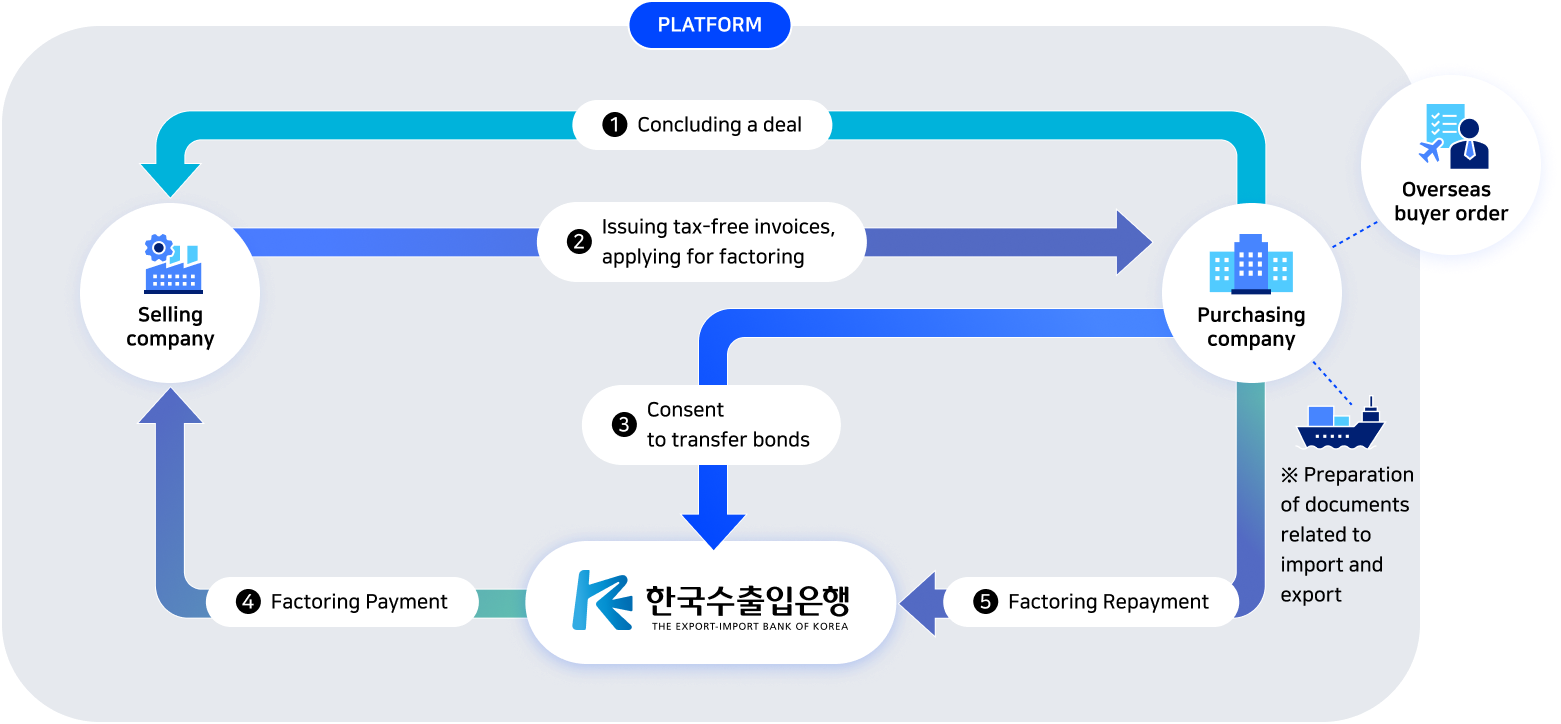

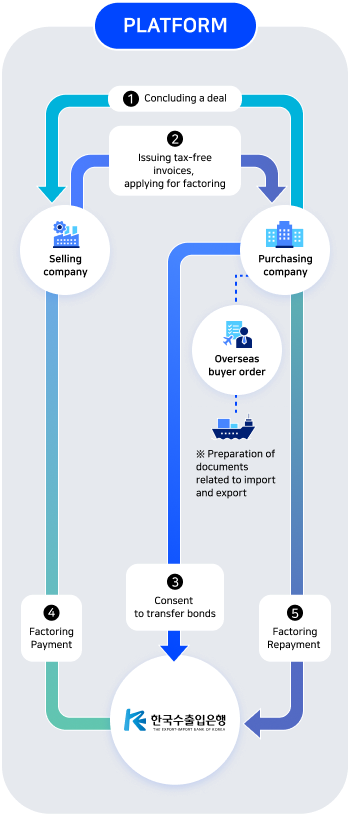

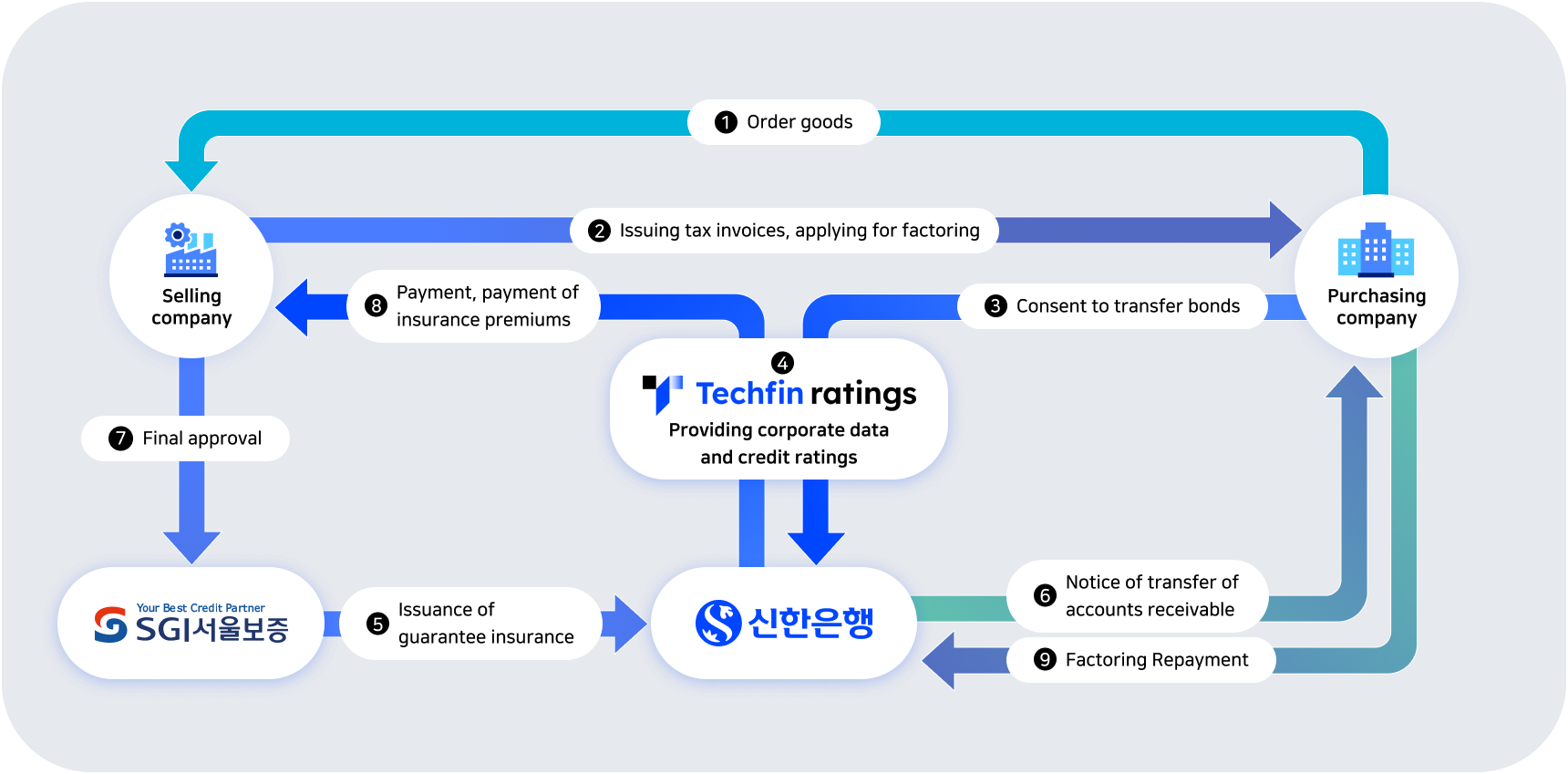

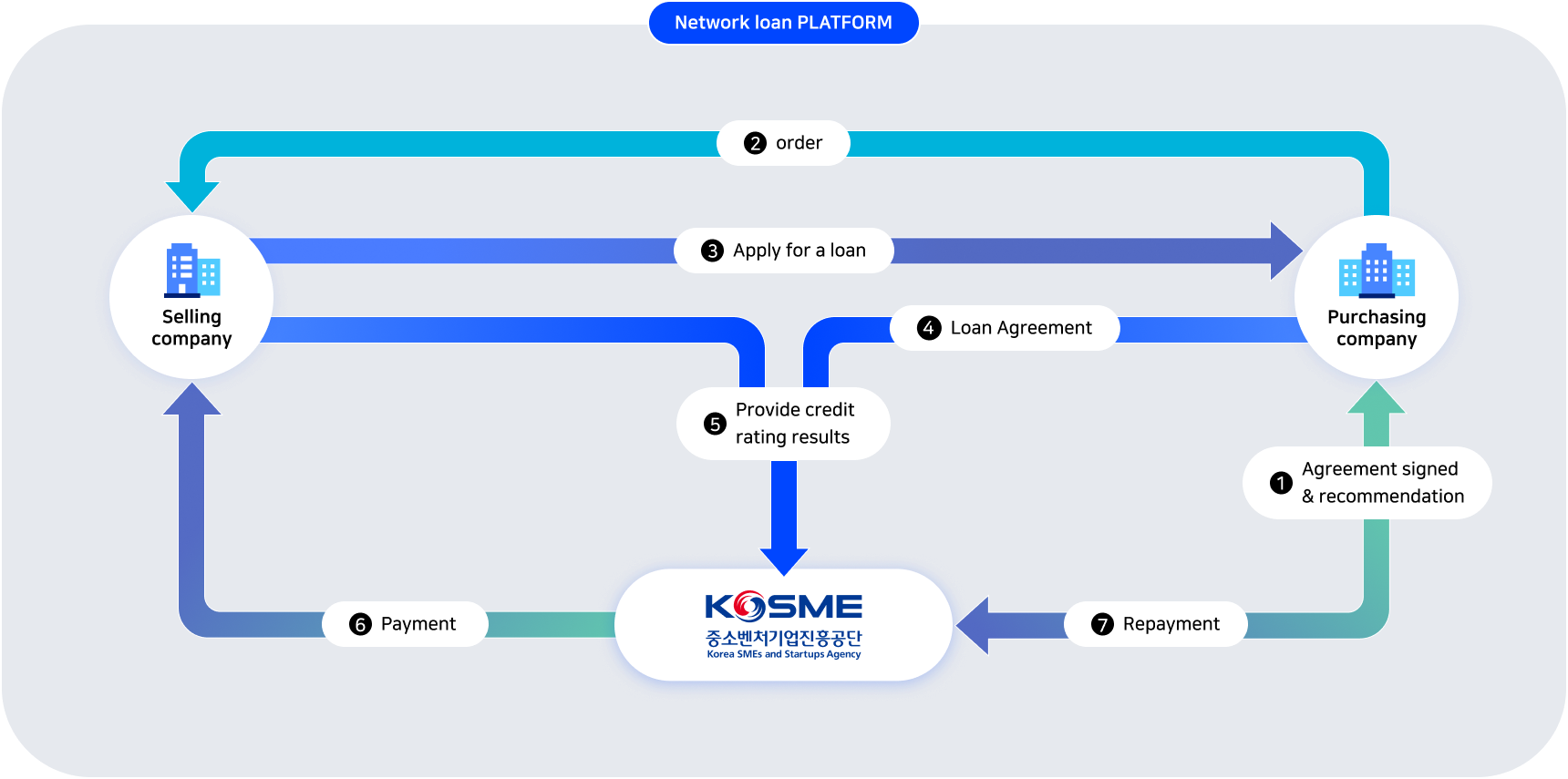

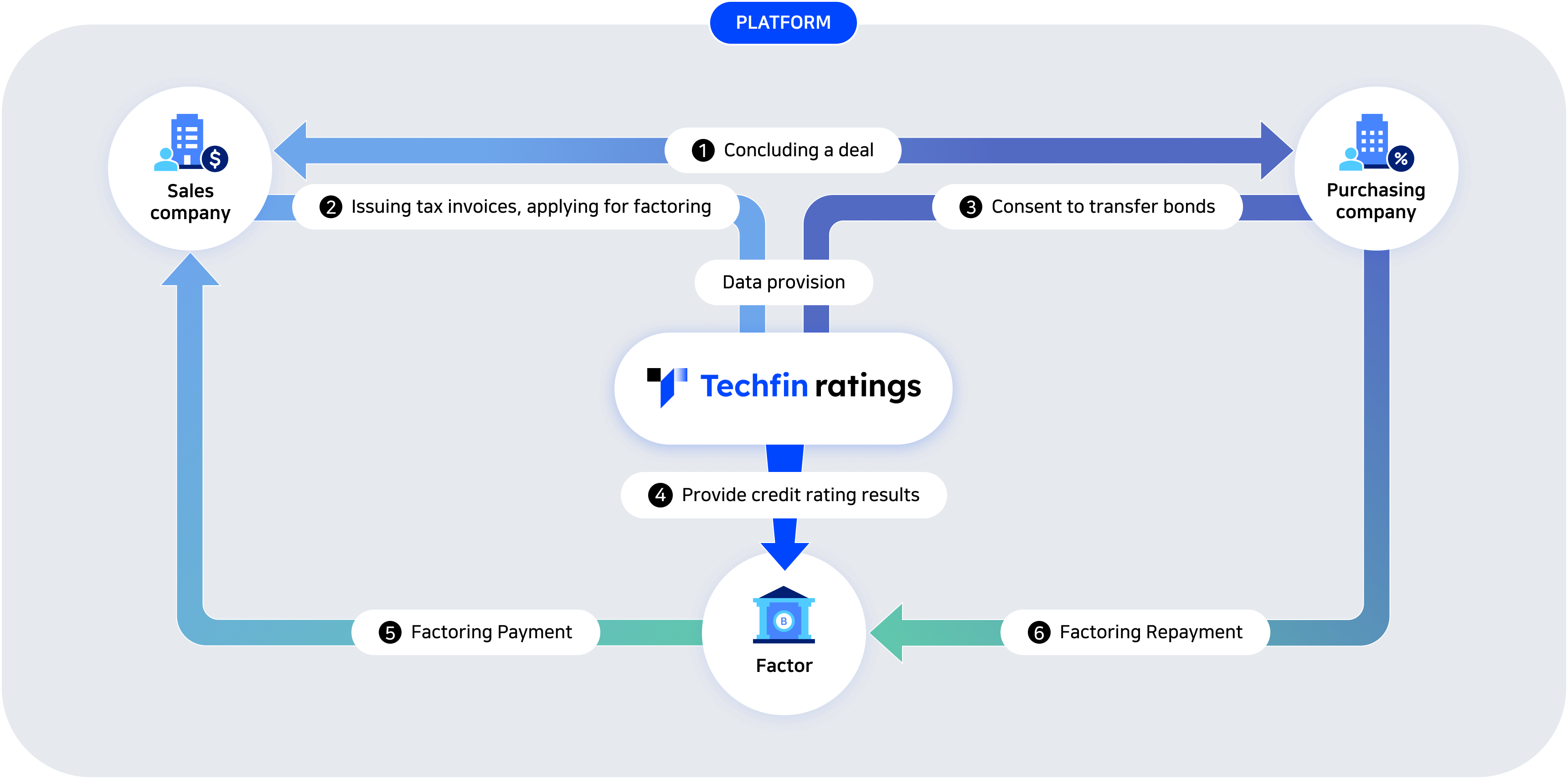

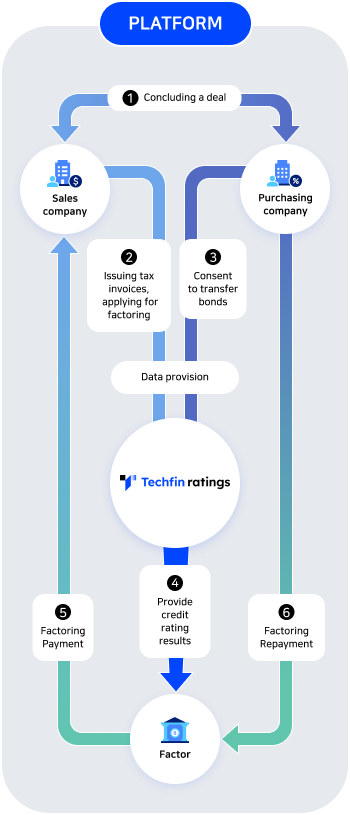

Account Receivables Factoring Process

Account Receivables

Factoring Process

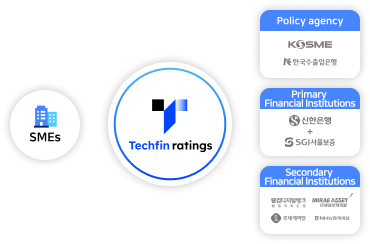

Affiliated Companies

- Factor

- Target

-

a tax-free invoice Issuing company (Vendor company of direct exporting company)

-

The sales company Available for small and medium-sized enterprises

-

Factoring for General Enterprise

-

For individuals / corporate business owners Factoring provided Limited to 40% of previous year's sales

-

partners who do business with Lotte affiliates Provides factoring to specialized corporate business entities

Video Clips For Accounts Receivable Factoring

Video Clips For

Accounts Receivable

Factoring

-

Douzone Counseling Center Open! All business owners with unstable cash flow

[Douzone Counseling Center] EP.01 -

How to resolve sales payment recovery issue

[Douzone Counseling Center] EP.02 -

Investing Secrets for Targeting Niche Markets

[Douzone Counseling Center] EP.03 -

Get cash right away with our accounts receivable factoring service!

[Douzone Counseling Center] EP.04

Contact Us

Contact Us